I n 2000, we built a business model based on doing the right thing for clients and associates. Beyond altruism, we knew it would set us apart in a competitive landscape.

Today, the same is still true.

Our model has helped us be distinctive at a time when bank size was getting in the way of client satisfaction. We also believed it was a path to reliable and sustainable growth over the long term to get consistent results for shareholders.

Today, the same is still true.

Since being listed on the NASDAQ in 2002, Pinnacle has been among the top-performing bank stocks in the entire country.

Some of what determines the share price is beyond our control. The larger economy, world events, political discourse—those are not in our hands. Instead, we keep our eyes on the factors we can control that we believe are most tightly correlated with long-term shareholder value.

We speak so often about our model for organic growth, how striving to hire the best talent in our markets helps us capture market share while reducing asset quality risk, because it’s been successful.

One reason our share price has fared so well over the last 18 years is due to the way our formula for organic growth works in combination with our approach to market expansion. The key to making it work is a firm belief in local control and a geographic focus. It’s not just that we hire the best bankers or seek to do the right things for all people. It’s that we give the power for hiring and the power for making those choices to the associates who are actually in the markets they serve.

By putting the decision-making power in the hands of local leaders, we can more easily make the right decision for us and our clients. We can feel confident that they are in the best interests of everyone involved and truly respond to what is needed.

At the same time, by having associates report up to a locally based leader instead of through a line of business based in Nashville, we foster a greater sense of teamwork, collaboration and ownership in helping the client. There is no “my team’s client” or “your team’s client.” They’re all “our clients.”

That’s a model that is extremely hard to replicate if you didn’t start with it from the beginning. Imagine taking a firm with billions or trillions in assets and trying to reconfigure it into a geographic focus. Or doing away with credit committees at headquarters. It would be next to impossible to achieve. Which is why we built Pinnacle that way from the beginning.

And because we started that way, it’s a model we can replicate in new markets.

As we expand, what’s easier than finding the right partner and letting them get right to work? Our model of local control and a geographic focus is a breath of fresh air in the high-growth markets we’re after.

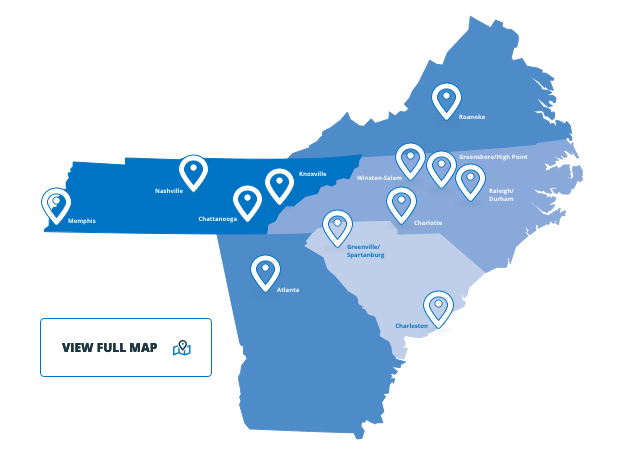

Whether by acquisition or de novo start, we have successfully exported our organic growth model to 11 markets in the Southeast, with a few more left to go on our wish list.

We could stay put in the markets we serve right now and continue our upward trajectory purely by growing our teams and taking more market share. But we see opportunity in additional Southeastern markets, and so we will keep working our expansion model in the ways it has been successful so far.

Our particular combination of acquisitive and organic growth has done well by our shareholders. 2019 was no different.

Pinnacle’s share price growth was the second highest in our peer group for 2019.

Dec. 31, 2018 — Dec. 30, 2019

- Q4

- Q3

- Q2

- Q1

Loans, deposits and revenues in millions.

For full financial data, including GAAP and non-GAAP measures, see our Business Insights.

Results like those are how we win. The potential in our markets to further those results is how we will keep winning.

Take a closer look at our high-growth markets to see how the combination of their strong economies with our proven model should help propel us to further growth.

Take a closer look at our high-growth markets to see how the combination of their strong economies with our proven model should help propel us to further growth.

Late in 2019 we entered the Atlanta market on a de novo basis. Anyone can lend money or take deposits in a market like Atlanta, but we believe it’s hard for other banks our size to deliver what we can. Pinnacle brings something new to the table in a crowded marketplace, that combination of community bank service with the resources and products of a bigger firm, that we think it is very difficult for another bank to replicate exactly.

Add to that a familiar environment that mirrors almost exactly the situation that was the catalyst for Pinnacle to begin with. Put that in the hands of a veteran local bank leader like Rob Garcia and the team he is assembling, and it’s a once-in-a-generation opportunity to build a major bank in a major American city.

This is the opportunity we were built for. We plan to seize it.